Debt Advisory/ Financing

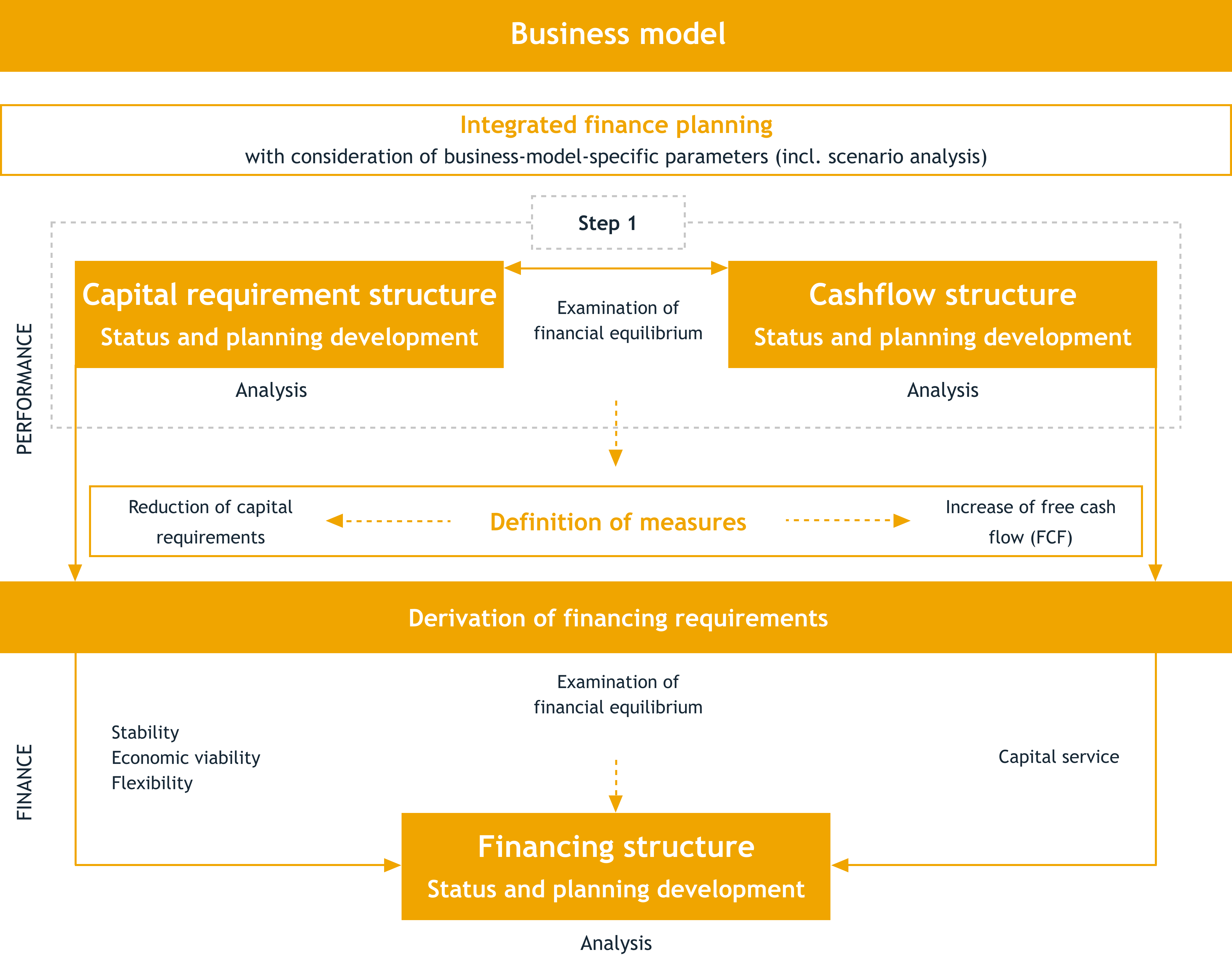

A customised financing is based on a profound understanding of the current situation of a company as well as an integrated financial plan which implies the planned corporate development supported by a financing strategy appropriate to the business model. By a combination of different financing instruments, a solid and, if necessary, equity-strengthening financing structure can be implemented for the future. The goal is to design the financing structure in such a way that stability, profitability and flexibility are optimally balanced for the planned development of the company with the resulting opportunity/risk profile and that the interests of the company are taken into account.

The first step is the performance analysis and evaluation of the planned company development, considering the underlying strategic positioning. In a best case, the detailed description and planning of the future development are documented in a structured way in a corporate concept with the derivation of an integrated financial plan. On this basis, the shareholders, the advisory board, and the possible financing partners can be provided with transparency about the financial effects as well as the opportunities and risks of the planned development of the company. In principal, a systematic and transparent decision-making basis is of crucial importance for adopting the corporate strategy and the realisation of the associated measures.

In a second step, the goal is to develop a financing structure appropriate for the business model, considering the specifics of the future business model and the level of capital requirements resulting from the leapfrog investment. With the view to the stability and flexibility of financing, the focus is not only on the expected future cash flow profiles but also on the effects on balance sheet ratios and possible drivers for relevant changes in capital requirements (raw material prices, volume changes, etc.). This is particularly important, as the financing must not immediately become imbalanced even in the case of performance-related developments that derivate from the plan (sensitisation).

The result of this business-model-appropriate financing structure is a mix of possible financing instruments tailored to this profile, which can, but does not have to, include the input of new equity or mezzanine capital to strengthen the company. The fully integrated financial model, including the business-model-specific financing strategy, forms the basis for the targeted selection and approach of suitable finance partners. Support in the implementation of the financing concept in its role as sparring partner and solution-oriented process driver for both internal and external issues is another essential component of the consulting activities of hahn,consultants.

Critical for the success of the finance structuring is the joint and consistent action of all involved parties. Targeted and transparent communication creates trust and avoids uncertainty. This process has proven itself in many practical cases. Learn more about the success of financial structuring in our article.

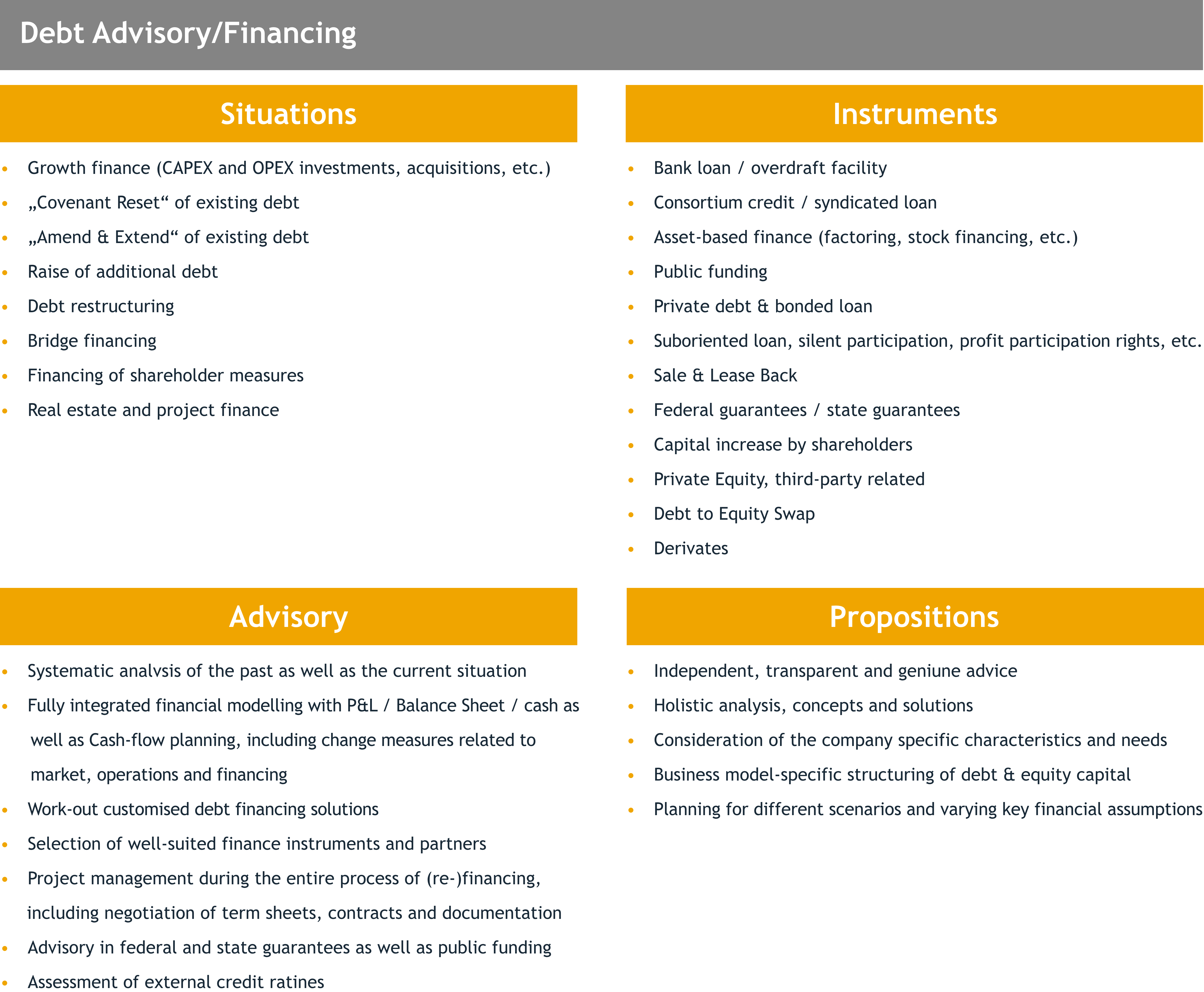

Our services at a glance:

- Work-out customised debt financing solutions

- Fully integrated financial modelling

- Business model-specific structuring of debt & equity capital

- Finance occasions: growth finance; extend & amend of existing debt; raise of new debt; debt restructuring

- Advisory in federal and state guarantees as well as public funding

- Project management during the entire process of (re-)financing, including negotiation of term sheets, contracts and documentation