Advice on the subjects of mergers and acquisitions (M&A) and succession planning

M&A

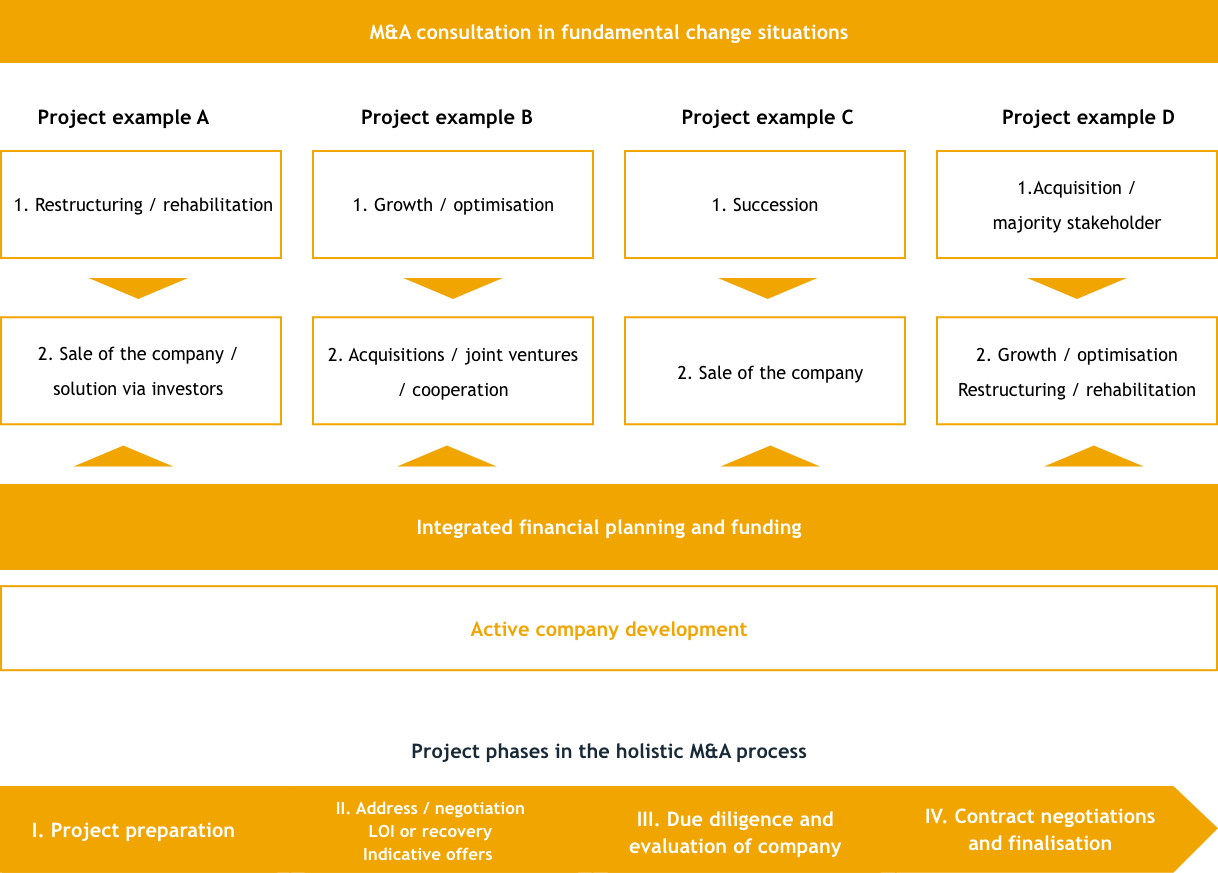

hahn,consultants understand M&A consultation as an integral consultation building block as part of holistic company development. Consultation in the context of the purchase and sale of companies, shareholdings, etc. occurs in situations with strong pressure for change, upstream or downstream of other key consulting areas. With this combination, situations of definite added value arise for the client.

Companies in situations of change often have to adjust their business model. Generally, these companies need additional management and capital resources for the future. Added value for companies and shareholders is realised when the important needs for change are identified early, and measures are preferably already developed and implemented to accompany the M&A process. The success of such fundamental change processes (transactions) depends, last but not least, on a range of qualitative and partially emotional factors, which have to be considered as much as the economic and framework conditions.

During the implementation of these transactions, we will be at your side with our advice:

- Spin-offs and disposal of individual business units of companies

- Capital increases / investor solutions

- Purchase and sale of companies

- Sale / purchase of company shareholdings or company shareholdings as part of capital increases

- Company mergers

- Strategic cooperation and joint ventures.

Depending on the initial situation and role, we guide the entrepreneur or management through the whole M&A process or hahn,consultants provide advice in clearly delineated issues or partial projects. We are happy to work with long-standing advisors of the client from the tax and legal consulting professions. We also have access to a network of attorneys, tax consultants, chartered accountants and other network partners, who have outstanding national as well as international knowledge in the area of company transactions.

With a comprehensive M&A consultation in the context of an integral advisory building block, the process we lead begins with the development, economic evaluation and comparison of the strategic action options of the entrepreneur. We advise the entrepreneur in the event of a sale or the search for a strategic partner or financial investor and, in the case of purchase, with the search for a suitable target company. We undertake due diligence, conduct international bidder processes and determine the value of a successful conclusion of contract.

We also provide focused support for the entrepreneur or management by giving advice as part of a specific query or as part of an ongoing accompanying role alongside another contracted M&A advisor in respect of a structured evaluation of options for action and decision-making, which is not driven by personal interest.

Once a transaction has been successfully concluded, we accompany our clients with the downstream operative development, possible funding challenges as well as the integration of an acquired company and also provide experienced management personalities as interim managers, should it be necessary.

Succession

Are you planning generational change in your company, or do you want to take on corporate responsibility in the future?

We are happy to support you with this by utilising our far-reaching expertise with the creation of company succession, while we will also accompany you with the development process of your company. With the classic project approach, we undertake a quick check regarding succession ability. Based on this, we develop an implementation concept with the relevant stakeholders and then support the implementation and the follow-up.

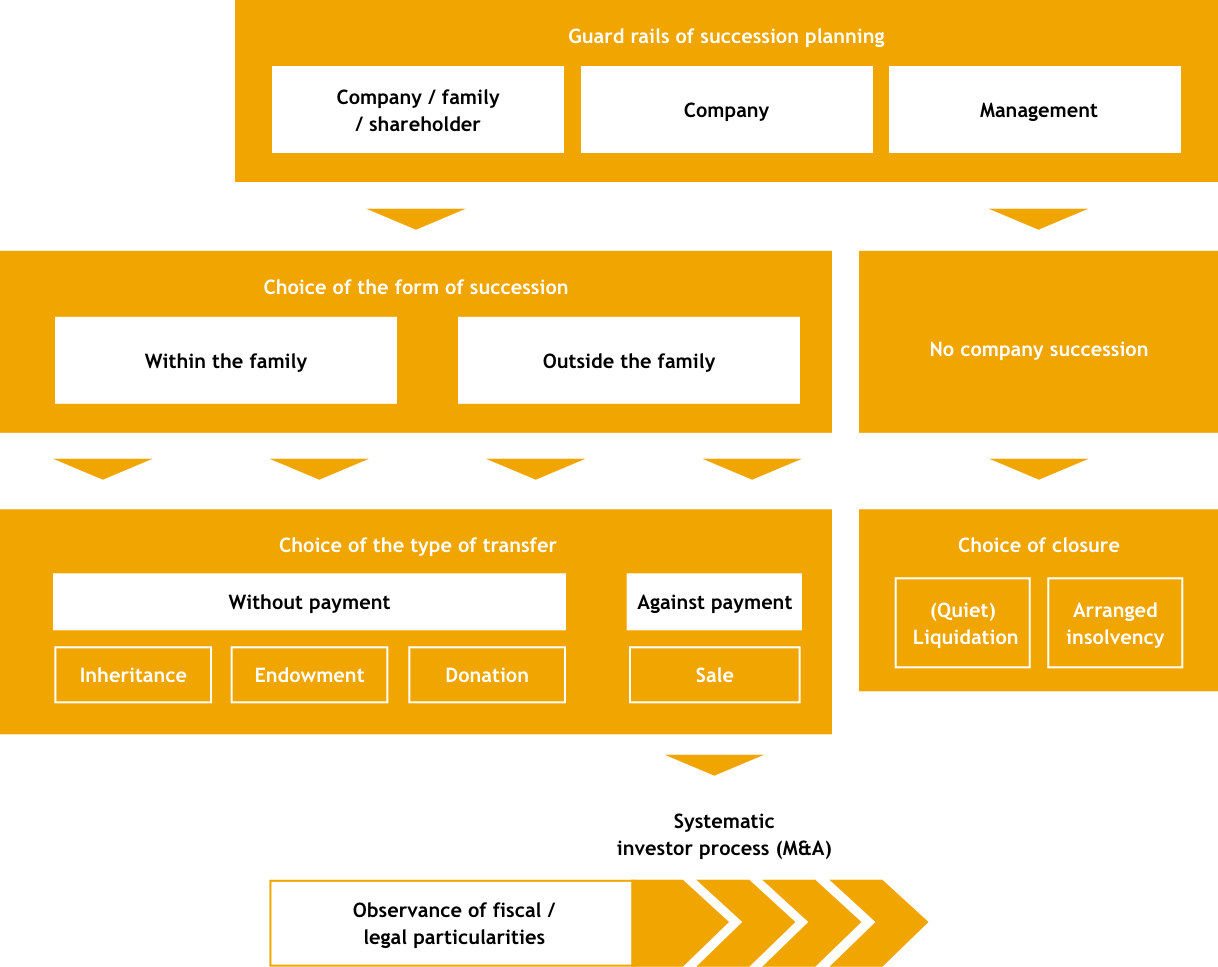

Family members active in the company, qualified employees (management buy-out) and third parties (management buy-in) can be considered as successors of a company. When setting guardrails for a company and its shareholders, we work out various options for action and evaluate them from the business perspective as well as from the perspective of the shareholders against the background of the companies and the developmental perspectives. In this, we do not only take into account the economic, but also the qualitative and sometimes emotional aspects of the planned company transfer.

We can say from experience that careful analysis of the initial situation and the development of perspectives at the start of the project are of fundamental importance for successful company succession. Here it is especially important to analyse and evaluate the basic economic, legal and tax compliance situation of the company as well as future challenges of the company, to be informed about the actual needs of the involved parties with a view on their further personal life planning in particular, to evaluate the professional and personal suitability of potential internal and external successors and to manage a voting and decision-making process, which is as transparent as possible for all involved parties.

We manage the entire succession process from one source and also design, if necessary, the financing structure of the company transfer. The process comprises the search for a suitable candidate via a systematic investor / M&A process as well as guiding the active development of the company. This also includes the evaluation of the company and leading negotiations with the successor and the finance partner. Should there really not be a succession solution, we advise you on an orderly withdrawal.

We are happy to work with your longstanding advisors from the tax and legal advisory professions. Naturally, we can also access very good contacts to attorneys, tax advisors and accountants upon request, who have proven expertise in the area of company succession.

In the same way, we support the successor with the operational transfer of the company in an advisory capacity upon request.